Sinossi

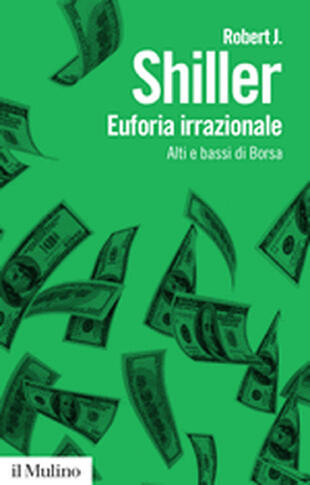

Oggi citatissimo sulle pagine di finanza dei quotidiani, il libro è apparso nel 2000, nel momento di apice dei mercati azionari di tutto il mondo, quando sembrava esserci nell'aria una sorta di stravagante aspettativa o, per dirla con Alan Greenspan, di "euforia irrazionale"; un ottimismo diffuso e non completamente giustificato circa l'andamento del mercato azionario. Shiller per primo aveva capito che solo interpellando economia, psicologia, demografia, sociologia, storia si poteva dare un vero contributo alla comprensione delle oscillazioni di Borsa. Mentre espone con chiarezza le implicazioni della finanza comportamentale per il mercato azionario Shiller fa vacillare le certezze dei teorici della finanza ed offre una lettura indispensabile per investitori, gestori di fondi, politici, manager e in generale per tutti coloro che non vogliono farsi sorprendere seduti sulla bolla speculativa quando inevitabilmente questa scoppia.

- ISBN:

- Casa Editrice:

- Pagine: 342

- Data di uscita: 12-02-2009

Recensioni

I really battled to get into this book. I didn't enjoy it at all. We all know that market bubbles exist and I really don't think Robert Shiller added much to the discussion (I will no doubt come under fire here from all the fans out there). This was summed up for me in the last chapter when he liste Leggi tutto

Two subjects I love: finance and psychology. Which is called behavioral finance, but whatever. All I can say is, I read the wrong edition. Ugh. The third edition is Shiller's grand middle finger to the markets after the crash of 08/09 and subsequent recession. I should have read that instead, but th Leggi tutto

This book serves as an awakening call from "the present...whiff of extravagant expectation, if not irrational exuberance, in the air. People are optimistic about the stock market. There is a lack of sobriety about its downside and the consequences that would ensue as a result." The author advances t Leggi tutto

A little dry for me. I actually ended up skimming through most of it because you could get the main point of each chapter in each chapters' final paragraph. I can see why this is a popular book, as Shiller discusses a lot of history about the stock market. However, I do not feel as though I've reall Leggi tutto

An important treatise on the oversized impact of structural and psychological biases in supposedly efficient, rational markets. [This book] is an attempt to characterize the complex nature of our real markets today, considering whether they conform or do not conform to our expectations and models.. . Leggi tutto

What a time to read a book about market panics & pandemics! It's interesting that when the market goes up, people assume it makes sense, because they're making money and they like it. But when the market goes down, they think it's an over-reaction, because they liked the higher number better -- becau Leggi tutto

For someone attempting to make sense of the market post-covid, metrics don’t begin to do the situation justice. Hence, a need for a deeper dive into bubbles. The crypto and tech stock phase and the “new era” rhetoric that accompany feel like they have been lifted directly from Shiller’s notes. Leggi tutto

Citazioni

Al momento non ci sono citazioni, inserisci tu la prima!