Sinossi

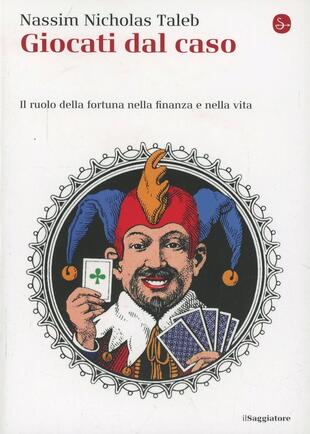

Con piglio narrativo e una serie continua di racconti e aneddoti Taleb ci spiega il ruolo che il caso e la fortuna hanno sulla nostra vita. Troppo spesso scambiamo per abilità e bravura quello che è solo fortuna. Utilizzando in modo divertente e accessibile la teoria della probabilità l'autore, che compare nel libro sotto l'aspetto del personaggio Nerone, un moderno Candide, spazia dal famoso processo al giocatore americano OJ Simpson alla filosofia di Karl Popper per dimostrare come l'ignoranza delle regole probabilistiche influenza ogni aspetto della nostra vita. Scambiare la fortuna per abilità può provocare danni enormi mentre saper riconoscere la casualità può rappresentare una fortuna per tutti.

- ISBN:

- Casa Editrice:

- Pagine: 0

- Data di uscita: 26-03-2014

Recensioni

You can't learn anything from this book; it's just a rant. The author's message is an incessant din of, 'I'm smart. They're stupid' "trading rooms were populated by people ..devoid of any introspection, flat as a pancake..." p28 "these scientists ... devoid of the smallest bit of practical intelligenc Leggi tutto

This is the first book I've read that suggests success is often more about luck than skill. Can we create our luck? 🤔 I hope so..... 😅 We frequently mistake random chance for skill, particularly in life and financial markets. The book highlights how unexpected events, like Black Swans, can lead to sig Leggi tutto

Renowned statistician George Box once said, “All models are wrong, but some are useful.” The author of Fooled by Randomness is all over the first part of this statement, but apparently doesn’t consider it part of his job as an iconoclast to say anything about the second. Taleb goes to great lengths Leggi tutto

I love the theses that he has in the book, but jesus christ, this is horribly written. I think the powerful ideas could have been condensed down to a New Yorker length article: 1. We tend to see the "survivors"; by hiding those who have failed, our understanding of many systems is skewed. 2. Leveraged Leggi tutto

The modern world regards business cycles much as the ancient Egyptians regarded the overflowing of the Nile. The phenomenon recurs at intervals, it is of great importance to everyone, and natural causes of it are not in sight.~ John Bates Clark, 1898 Yeah, right!~ Nassim Nicholas Taleb, 2001

دربارهی نویسنده آقای نسیم نیکلاس طالب را میتوان آماردان، معاملهگر بازارهای مالی، و کمی اقتصاددان دانست، اما شهرت این نویسندهی لبنانی/آمریکایی به خاطر معاملههای مالی یا دانش اقتصادیاش نیست. او نظریهپردازی است که اگرچه ایدههایش قبلا هم توسط دیگران به صورت پراکنده مطرح شدهاند، ولی او در کتابهای Leggi tutto

One of my business school professors raved about this book. I expected to get an entertaining and informative investment professional's take on how our irrational tendencies keep us from applying basic probabilities that would help us make better decisions. Instead, this book read like a pretentious, Leggi tutto

1) فرض کنید که یک روز تلفن ناشناسی دریافت میکنید که به شما میگه "فردا فلان سهم، مثبته و به نفعته خریداری کنی!". مسلما شما این تماس رو خیلی جدی نمیگیری. هر چند فردای اون روز حتما بازار رو رصد میکنی و احتمالا کمی متعجب میشی از اینکه سهم مذبور، مثبت بود. دوباره روز بعد این قضیه تکرار میشه. "فردا ف Leggi tutto

Citazioni

Al momento non ci sono citazioni, inserisci tu la prima!